EV Tax Credit*

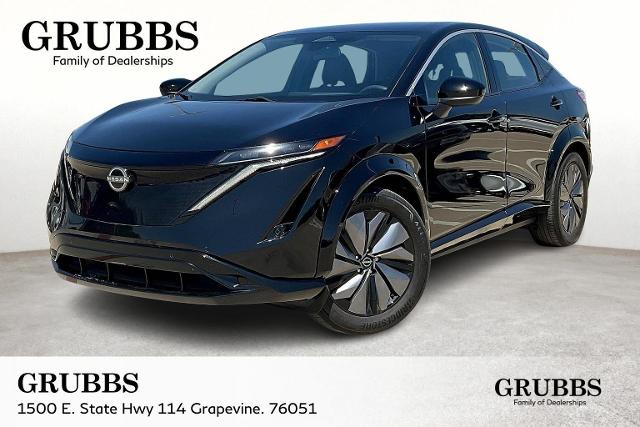

2023 Nissan ARIYA ENGAGE

- Offer Amount $4000

- Grubbs Price: $20,700*

- Stock Number: PM407846

The $4,000 Electric Vehicle (EV) Tax Credit is subject to the regulations and guidelines set forth by the relevant government authorities.

Offer Disclosure

*The $4,000 Electric Vehicle (EV) Tax Credit is subject to the regulations and guidelines set forth by the relevant government authorities. This disclaimer serves to inform potential beneficiaries of certain important points regarding eligibility and conditions associated with claiming the tax credit:

Eligibility Criteria: To qualify for the $4,000 EV Tax Credit, individuals must meet specific eligibility criteria as determined by the governing tax authority. This may include factors such as the type of vehicle purchased, its battery capacity, and the purchaser's tax liability.

Tax Liability: The $4,000 EV Tax Credit is non-refundable, meaning it can only reduce the amount of tax owed to zero. If an individual's tax liability is less than $4,000, they may not be able to fully benefit from the entire credit amount.

Phase-Out Threshold: The EV Tax Credit may be subject to phase-out thresholds based on the number of electric vehicles sold by a manufacturer. Once a manufacturer reaches the designated threshold, the tax credit for their vehicles may begin to decrease or phase out entirely over time.

Consultation with Tax Advisor: Individuals considering claiming the EV Tax Credit are encouraged to consult with a qualified tax advisor or accountant to assess their eligibility and understand the potential impact on their tax situation. Tax laws and regulations are subject to change and interpretation, and professional advice can provide clarity and ensure compliance.

Documentation and Reporting: Claimants must retain all necessary documentation related to the purchase of the electric vehicle and the claimed tax credit. This documentation may be required to substantiate the claim and may need to be provided upon request by the tax authorities.

Limitations and Exclusions: The $4,000 EV Tax Credit may not be applicable in certain jurisdictions or under specific circumstances. Additionally, certain types of electric vehicles, such as plug-in hybrids or electric motorcycles, may have different eligibility criteria or credit amounts.

Validity Period: The information provided in this disclaimer is based on current regulations and guidelines as of [current date]. Tax laws and incentives are subject to change, and individuals should verify the latest updates from the relevant tax authority or government agency.

Responsibility of the Claimant: Claiming the $4,000 EV Tax Credit is the responsibility of the taxpayer, and they are accountable for ensuring compliance with all applicable laws and regulations. Any errors or discrepancies in claiming the tax credit may result in penalties or fines imposed by the tax authorities.

Example VIN

JN1AF0BA9PM407846

GRUBBS INFINITI Provides Auto Service Offers in Grapevine

Start saving a lot of cash nowadays on your next new car or SUV from GRUBBS INFINITI. You have the opportunity to save hundreds or possibly thousands of dollars with regards to the purchasing or leasing of your next vehicle. Our dealership provides specials and offers on your favorite automobiles and motorists from all around the area have taken advantage of this chance. No matter if you are from Dallas, Fort Worth, or Arlington, make your quick journey over and experience how much you are able to preserve. In case you have questions regarding all the ways for you to save when buying or leasing from GRUBBS INFINITI, phone us at +01 soon. We now have helpful dealership professionals on-hand that are ready to respond to all the questions that you may have. Give us a call today to get in touch and schedule a test drive. New car shoppers all around the Dallas area have found great savings on INFINITI specials offered by us at our Grapevine, TX dealership, and we want to help you save too.